Mastering the Art of Investing: Essential Strategies for Success

Written on

Chapter 1: Understanding Investment Fundamentals

Investing is widely regarded as one of the most effective means of accumulating wealth. However, many people underestimate the nuances involved in successful investing. It's not as complicated as rocket science, yet it requires more than merely taking random shots in the dark. The key to successful investing lies in understanding investor behavior rather than just the selection of investments.

Before diving into the principles of investing, it’s crucial to clarify what investing is not.

Joshua Mayo on Unsplash

What Investing Isn't

Investing vs. Trading

Investing is not synonymous with trading. While trading involves frequent buying and selling of securities such as stocks and bonds, investing focuses on making decisions that reflect your risk tolerance, time frame, and overall financial health, particularly in relation to companies and investment vehicles that have demonstrated success over time.

For instance, if you have a low risk tolerance, purchasing junk bonds would be misaligned with your investment approach. Similarly, investing in cryptocurrency based solely on a friend's recommendation may not suit a conservative investor who needs access to funds within a few years.

Investing vs. Saving

Many people confuse investing with saving. Although both involve setting aside money for future use, they are fundamentally different. Saving typically ensures that you won't lose your principal amount, whereas investing carries the risk of fluctuating values depending on market conditions.

Investing vs. Speculating

Speculating entails making high-risk investments based on tips or trends, such as buying penny stocks in a speculative mining venture or investing in cryptocurrencies without a solid foundation. Unlike investing, which is grounded in a thorough analysis of potential returns, speculation lacks a reliable basis for decision-making.

According to Benjamin Graham, "The individual investor should act consistently as an investor and not as a speculator."

The Essence of Investing

Investing is fundamentally about acquiring assets with the expectation that they will appreciate in value and generate income.

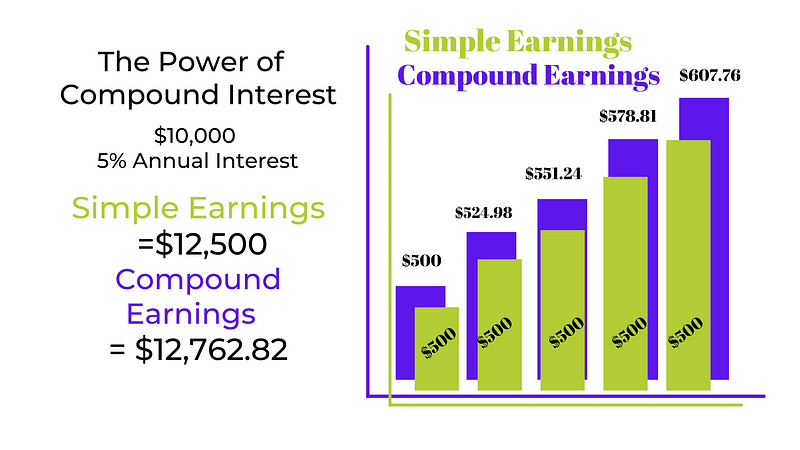

Created on Canva

Chapter 2: Eight Key Strategies for Successful Investing

After decades of experience in teaching and managing investments, here are eight essential tips for becoming a successful investor.

1. Invest with Purpose

Align your investments with your core values, objectives, and risk tolerance. Clearly outline your financial goals and categorize them by their anticipated timelines. For example, if you aim to purchase a home in the next three years, you should focus on short-term, low-risk investments.

2. Keep Emotions in Check

Effective investing requires a rational approach. Many investors tend to buy high and sell low due to emotional influences like fear and greed. As Warren Buffett wisely noted, "The most important quality for an investor is temperament, not intellect."

3. Include Dividend-Paying Stocks

Make sure a portion of your portfolio consists of dividend-paying stocks. Dividends offer a source of passive income that can be reinvested through Dividend Reinvestment Plans (DRIPs), fostering your investment growth.

4. Maintain a Safety Net

Regardless of your investment style, it's prudent to keep 10% to 20% of your portfolio in safe assets like cash or bonds. This acts as a buffer during market downturns.

5. Diversify Your Investments

Avoid concentrating your investments in one area. Spread your assets across various classes—cash, bonds, stocks, and alternatives—to mitigate risks and enhance potential returns.

6. Avoid Market Timing

No one can predict market movements with certainty. John Templeton famously remarked, "Bull markets are born on pessimism... The time of maximum pessimism is the best time to buy." Instead of trying to time the market, focus on maintaining a long-term investment strategy.

7. Commit to Investing Regularly

The growth of your assets is directly correlated with the time they are allowed to mature. Start investing now, regardless of how small the amount, and allow your investments to compound over time.

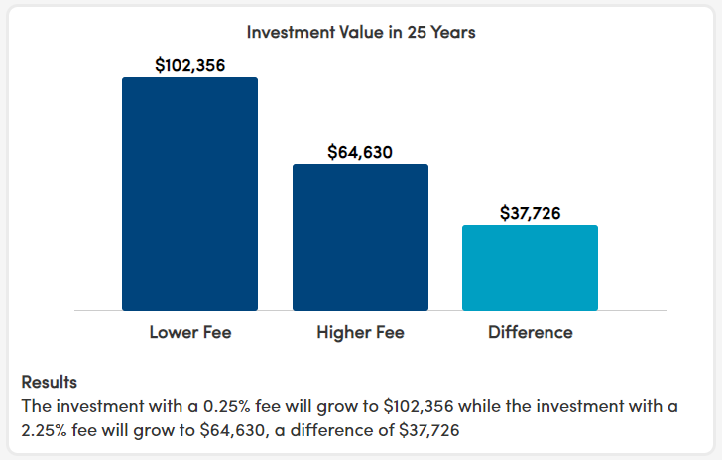

8. Minimize Costs

High fees associated with actively managed mutual funds can eat into your returns. Many investors are shifting towards lower-cost options like exchange-traded funds (ETFs) that mirror major indices, such as the S&P 500.

Bringing It All Together

Becoming a successful investor doesn't require you to be an economist or a financial guru. By learning from experts and embracing calculated risks, you can navigate the world of investing effectively. These eight strategies serve as a foundation for your investment journey. Consider expanding your knowledge through reputable books and courses, as your financial future is worth the investment.

Discover eight essential investing tips that can significantly impact your financial future.

Learn how a beginner can make substantial earnings through smart stock investments.