Maximizing Profits Through AI: A Comprehensive Guide

Written on

Chapter 1: Understanding AI Profitability

In a world saturated with recycled information, it’s becoming increasingly challenging to find unique insights about AI and its profit potential. We know AI can produce written works, but the real question is: how can we leverage AI for financial gain?

One promising approach is known as the White Label Method, which offers an enticing opportunity to generate revenue. However, before diving into specifics, let's first explore the foundational elements that make AI's potential a reality.

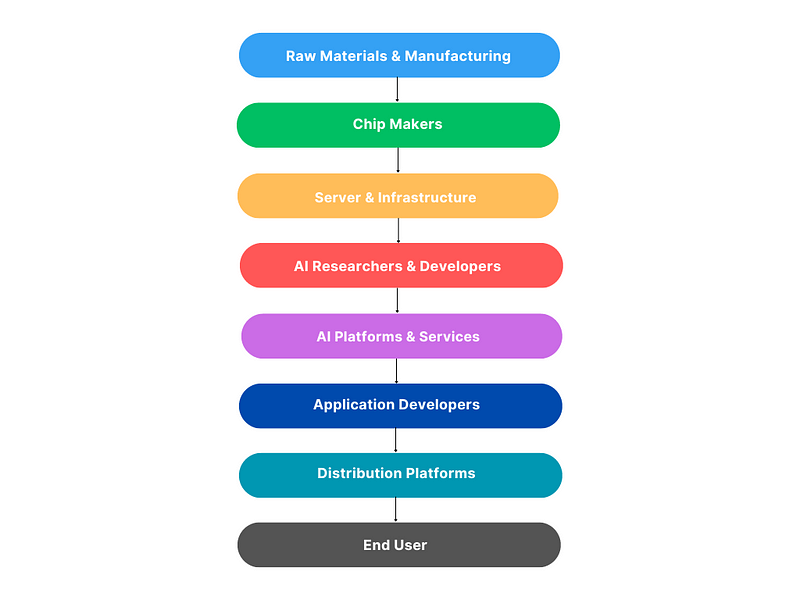

Chapter 1.1: The AI Journey

To truly grasp how to monetize AI, we need to break down various sectors and their opportunities.

- Raw Materials and Manufacturing

- Mining and Sales: Extract raw materials for chip production.

- Refinement: Enhance raw materials for better usability.

- Consulting: Provide expertise in efficient extraction and refinement.

- Education: Gain knowledge in related fields for better opportunities.

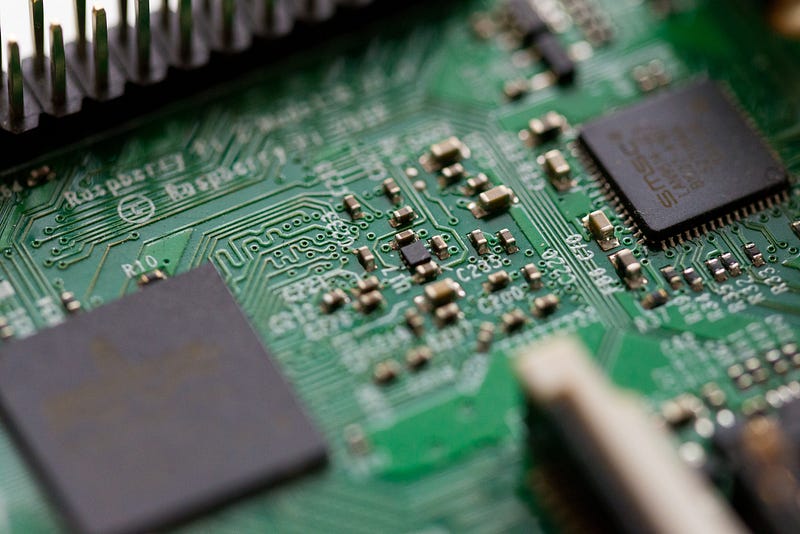

Did you know that silicon, a crucial component in chip manufacturing, is derived from a mix of sand and quartz? This semiconductor is vital for the industry, which has ballooned to an estimated $515 billion in 2023 and is projected to reach $1 trillion by 2030.

Chapter 1.2: Investment Opportunities in Semiconductors

Instead of recommending individual stocks, consider the following top ETFs in the semiconductor sector:

- iShares Semiconductor ETF (SOXX)

- VanEck Semiconductor ETF (SMH)

- SPDR S&P Semiconductor ETF (XSD)

- First Trust Nasdaq Semiconductor ETF (FTXL)

- Invesco PHLX Semiconductor ETF (SOXQ)

Additionally, you may want to explore commodity ETFs to capitalize on the rising demand for raw materials, such as:

- SPDR S&P Metals & Mining ETF (XME)

- iShares MSCI Global Metals & Mining Producers ETF (PICK)

- VanEck Rare Earth/Strategic Metals ETF (REMX)

- Invesco DB Base Metals Fund (DBB)

The first video titled 7 AI Tools that Will Make You RICH (in 2024) discusses essential tools that can help you profit from AI technologies. It outlines the potential for financial success through the strategic use of these tools.

Chapter 1.3: Chip Manufacturing Ventures

- Hardware Sales: Sell AI-optimized chips (GPUs, TPUs) to tech firms.

- Licensing: License chip designs to other manufacturers.

- Custom Solutions: Create tailored chips for specific applications.

Chip manufacturers like Nvidia have seen remarkable stock increases, illustrating the demand for their products. The rise in gaming, cloud computing, and cryptocurrency mining during the pandemic accelerated this growth, particularly as the company pivoted towards AI applications.

The chip industry in the U.S. is projected to add approximately 115,000 jobs by 2030, creating ample opportunity for investment in this sector.

Chapter 2: Cloud Services and Infrastructure

The second video, 10 Ways To Actually Make Money With AI (For Beginners), provides practical insights for novices looking to monetize AI technologies.

Cloud services are critical for the delivery of computing resources and data storage. Platforms like OpenAI and Microsoft have formed lucrative partnerships, with Microsoft being the exclusive cloud provider for OpenAI's products.

Don't overlook Google, which operates one of the largest cloud infrastructures globally. Their extensive services, including Google Console and Google Drive, are all part of the Google Cloud Platform.

To tap into this growth, consider investing in cloud infrastructure companies such as Google, Microsoft, and Amazon, or explore these top ETFs:

- First Trust Cloud Computing ETF (SKYY)

- Global X Cloud Computing ETF (CLOU)

- Wedbush ETFMG Global Cloud Technology ETF (IVES)

- Fidelity Cloud Computing ETF (FCLD)

- WisdomTree Cloud Computing ETF (WCLD)

Chapter 3: AI Research and Development

The AI sector is not just about technology but also involves significant research and development. Renowned companies such as IBM, Google, and Amazon are leading the charge, contributing to a projected market value of $738.80 billion by 2030.

Chapter 4: Platforms and Services

AI platforms are the backbone of various applications, including content generation and image creation. Companies like OpenAI and Google are at the forefront of developing these technologies.

Investing in leading companies referred to as "The Magnificent 7" (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta) can provide lucrative returns, as these stocks have seen substantial growth in 2023.

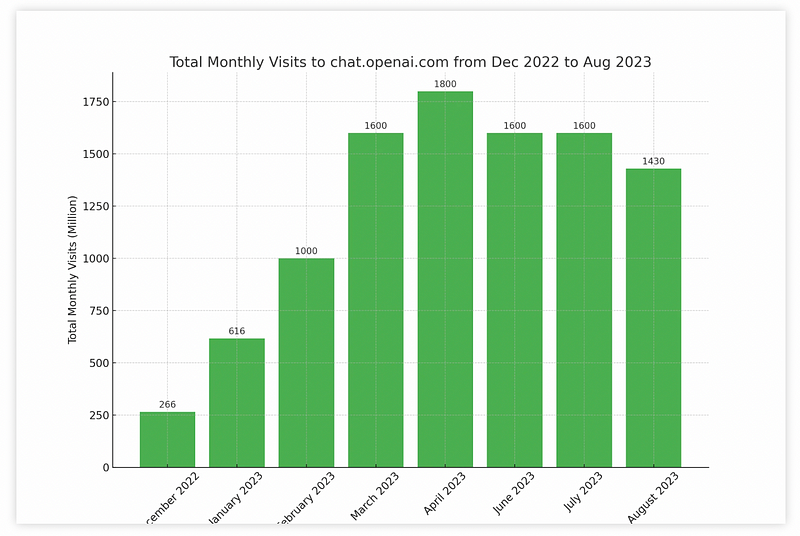

Chapter 5: Distribution and User Engagement

The final step in this journey involves reaching the end user. AI's capabilities can enhance productivity across various sectors, and as technology continues to evolve, the potential applications of AI are virtually limitless.

In conclusion, the AI landscape offers numerous avenues for investment and profit. By understanding these sectors and exploring innovative strategies, you can position yourself to benefit from the ongoing AI revolution. Are you ready to take the plunge?