The Million-Dollar Dilemma: Choosing Between Cash and Compounding

Written on

Chapter 1: The Compounding Challenge

Imagine being presented with a choice: take a lump sum of $1 million right now or opt for a single penny that doubles in value every day for a month. At first, the million dollars may appear to be the clear winner, but let’s delve deeper into the implications of each option.

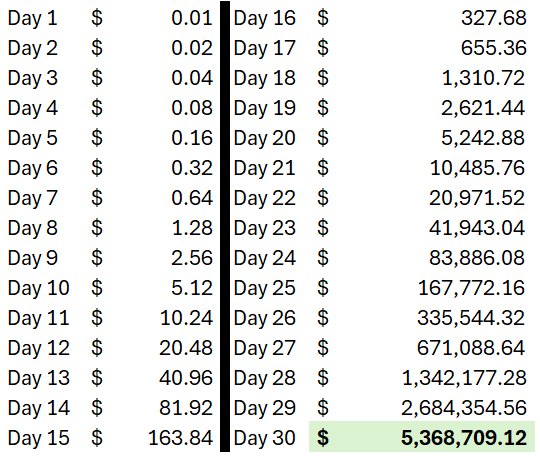

Choosing the immediate $1 million might feel like a wise move initially. Yet, consider the alternative scenario. By starting with just a penny that doubles each day, here’s how your investment would evolve:

After 30 days, that small penny would have grown into over $5.3 million. This example illustrates the remarkable power of compounding, a fundamental concept in finance.

Understanding Financial Literacy

Financial literacy refers to your ability to manage money effectively and understand the various avenues for saving and investing. Think of it as a guide that leads you toward significant financial milestones, such as:

- Accumulating savings for major purchases

- Financing education

- Planning for retirement

- Buying a home

- Reducing debt

- Investing for long-term benefits

Equipped with a solid understanding of these topics, you can make educated decisions, set realistic goals, and work toward achieving financial stability and independence. It’s up to you to navigate this journey wisely, ensuring you arrive at your financial objectives while dodging potential pitfalls along the way.

Overcoming Financial Literacy Barriers: A Practical Guide

- Educate Yourself

- Online Courses: Platforms such as Coursera, Khan Academy, and Udemy provide personal finance courses.

- Financial Apps: Use apps like Mint, YNAB (You Need A Budget), and PocketGuard to manage your finances.

- Workshops: Attend community seminars focused on financial literacy.

- Simplify Complex Ideas

- Real-Life Examples: Connect financial principles to everyday scenarios for better comprehension.

- Educational Videos: Channels like The Financial Diet and TED-Ed offer accessible explanations of financial topics.

- Utilize Practical Tools

- Budgeting Apps: Tools like Mint or YNAB can help you track expenses and create budgets.

- Online Calculators: Websites such as NerdWallet provide calculators for loans, investments, and savings.

- Develop Emotional Intelligence

- Mindfulness Practices: Techniques like meditation can enhance your decision-making capabilities.

- Reflective Journaling: Maintain a journal to assess your spending habits and reflect on financial choices.

- Enhance Strategic Thinking

- Set Clear Goals: Clearly define your financial aspirations and draft a plan to achieve them.

- Decision-Making Skills: Engage in courses or read literature on strategic thinking and decision-making.

- Engage with Interactive Resources

- Gamified Learning Apps: Explore apps like Finimize and Peak for interactive finance education.

- Podcasts: Tune into financial podcasts like “Planet Money” and “The Dave Ramsey Show” for actionable insights.

Why Financial Literacy is Essential for Young Adults

Smart Spending & Saving

Establishing a budget with tools like Mint or YNAB is key to managing your finances. Prioritize essential expenditures while minimizing discretionary spending to increase savings. Automate monthly transfers to your savings account, aiming for an emergency fund that covers 3–6 months of expenses. High-yield savings accounts can also help maximize interest on your deposits, keeping you motivated toward your financial goals.

Benefits of Early Investment

Grasping the principle of compound interest is vital. Initially, I hesitated to invest, thinking I needed significant capital to start. However, I discovered that beginning with smaller amounts could lead to considerable growth over time. Platforms like Forbright Bank facilitated my entry into investing, allowing me to benefit from compounding.

Future Planning

Financial literacy empowers you to prepare for long-term objectives, such as retirement, purchasing a home, or starting a family. Defining financial goals and strategizing to reach them has been crucial for my financial well-being. Tools like GoalsOnTrack have helped me remain focused and motivated as I monitor my progress.

Debt Management

Effective debt management is essential for maintaining financial stability. Here are some widely recognized strategies:

- Debt Snowball Method: Concentrate on repaying the smallest debts first while making minimum payments on larger ones. Once a smaller debt is eliminated, proceed to the next smallest. This approach fosters quick wins and builds momentum.

- Debt Avalanche Method: Focus on paying off debts with the highest interest rates first while maintaining minimum payments on others. This method can help you save more on interest in the long run.

- Debt Consolidation: Combine multiple debts into a single loan with a lower interest rate, simplifying payments and potentially lowering total interest.

- Debt Management Plan (DMP): Collaborate with a credit counseling agency to establish a structured repayment plan, negotiating lower interest rates and monthly payments on your behalf.

Building a Safety Net

An emergency fund is crucial for financial resilience. I understood its significance when unexpected expenses caught me off guard. By saving 3–6 months’ worth of living costs, I created a buffer against financial difficulties. Budgeting apps and automated savings features made this process straightforward and consistent.

Grasping financial literacy goes beyond making smart choices today; it’s about safeguarding your future. The concept of compounding, as shown by the penny example, illustrates how informed decisions can lead to substantial growth over time. By educating yourself, simplifying complex ideas, and utilizing practical tools, you can overcome financial challenges and establish a strong foundation. My journey from uncertainty to financial security demonstrates that with the right knowledge and tactics, anyone can achieve their financial ambitions. Embrace financial literacy and take charge of your financial future today.

The first video titled "Financial Literacy For Beginners! Start Learning About Personal Finance And Managing Your Money" offers essential insights for those starting their financial journey.

The second video, "Financial Literacy - A Beginners Guide to Financial Education," provides foundational knowledge that can help build your financial skills.

Disclaimer: This article serves as informational content and is not intended as financial advice. While I strive for accuracy, please verify any information before making financial decisions. It’s advisable to consult a qualified financial advisor for tailored advice based on your situation. I am not liable for any losses or damages that may arise from using this information. Past performance is not indicative of future results.