Reasons to Be Optimistic About Crypto in 2022

Written on

Chapter 1: The Bullish Case for Cryptocurrency

Investors have multiple reasons to feel optimistic about the crypto market. This analysis is backed by Luno Global, a platform designed for buying, saving, and managing cryptocurrencies. While the future remains uncertain, historical trends can guide our expectations. Here are three reasons to be optimistic about cryptocurrency in 2022!

1. Bitcoin's Finite Nature

Looking at the bigger picture is essential. In a market with active traders and liquidity, prices will inevitably fluctuate. For instance, Bitcoin has experienced swings from $30,000 to $63,000, then back down to $29,800, reaching $67,500, and finally settling around $35,000 in the past year, as per Messari data. Such volatility is expected to continue in the short term.

Newcomers often ask, “What will the price be next week?” However, I believe the more crucial question is, “Where will it stand in five, ten, or even twenty years?”

There is a cap of 21 million Bitcoins that can ever exist, with approximately 3.7 million believed to be lost, leaving around 17.3 million in circulation. Unlike Bitcoin, fiat currencies can be printed infinitely by central banks, leading to potential devaluation.

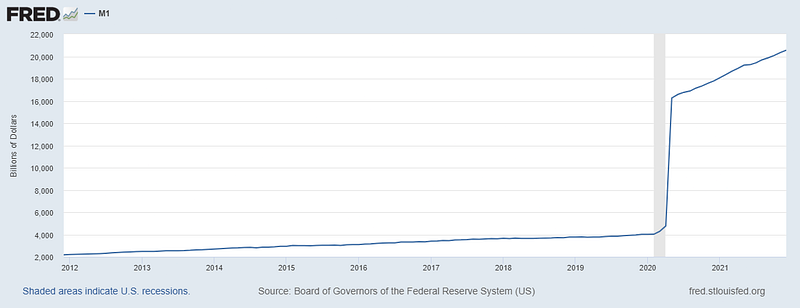

As illustrated in the chart below, the M1 money supply has seen considerable growth over the last decade.

If fiat currencies continue to lose value, we can expect Bitcoin's worth to rise in the long run. Essentially, as long as the demand and supply dynamics for Bitcoin remain stable, the depreciation of fiat will continue to elevate its price.

2. Growing Institutional Interest

Indeed, institutions are getting involved. Remarkably, in just one year, major entities like Tesla, Square, and MicroStrategy, along with the government of El Salvador, have added Bitcoin to their balance sheets. For a more comprehensive overview, check BitcoinTreasuries.net.

In the U.S., two Bitcoin Futures Exchange Traded Funds (ETFs) received approval from the U.S. Securities and Exchange Commission, and Canada has also approved two Bitcoin Spot ETFs. Notably, mayors from New York City and Miami have opted to receive their salaries in Bitcoin, and several NFL players, including Russell Okung, Tom Brady, and Saquon Barkley, have followed suit.

This institutional interest has resulted in consistent positive net inflows into Bitcoin and other cryptocurrencies weekly, as detailed by CoinShares. Numerous global events are also contributing positively to Bitcoin's long-term price trajectory.

3. The Importance of Regulation

Surprisingly, regulatory clarity can be seen as a positive factor for crypto investors. Regulatory uncertainties often deter institutional investments in Bitcoin and other digital assets. Conversely, clearer regulations could pave the way for more significant inflows.

The Congressional Blockchain Caucus, which is expanding, represents one of the few bipartisan initiatives in Washington, D.C. Their goal, as stated on their website, is to foster a "light touch" regulatory approach towards cryptocurrencies, which is crucial for pro-Bitcoin regulations in the U.S.

The Ripple SEC lawsuit is another significant aspect to consider. Its resolution could have bullish implications for XRP, potentially leading to its relisting on major U.S. exchanges. This would be a strong catalyst for price increases, and either outcome would contribute to greater regulatory clarity for various tokens.

Looking Ahead to 2022 and Beyond

I must emphasize that past performance is not indicative of future results. Keeping that in mind, the factors discussed above present a long-term bullish outlook for cryptocurrency.

I am also optimistic about:

- Cross-chain projects such as Polkadot (DOT)

- More stable DeFi options like Nexo Finance (NEXO) and Pancake Swap (CAKE)

- Ethereum Layer Two solutions for gas fees, like Polygon (MATIC)

- High-quality blockchain gaming initiatives like Star Atlas and Pizza NFT

Could there be short-term challenges? It's possible, and I am somewhat conflicted. However, I remain confident that wise investments typically appreciate over time, and the best opportunities arise when asset values are low.

Still skeptical? I have mixed feelings, so I have opted to present two separate analyses—one bullish and one bearish.

If you're interested in a more cautious perspective, you can read my bearish outlook here.

This content serves educational purposes only and does not constitute trading advice. Past performance does not guarantee future results. Always invest only what you can afford to lose. The author may hold assets mentioned in this article.

If you found this analysis valuable and wish to create your own content, consider Quantum Economics’ Analysis on Demand service.

Explore three compelling reasons to remain optimistic about Bitcoin's future in this informative video, which analyzes the current trends and potential growth.

Discover the implications of institutional buying in this video that discusses how influential figures like Nancy Pelosi may impact the crypto landscape.