Revolutionizing Banking: Apple's New Savings Account and More

Written on

Chapter 1: Apple's Game-Changing Savings Account

Would you consider switching your bank for Apple?

Banks are facing significant challenges—not due to inflation, recessions, or geopolitical conflicts, but because they are underestimating Apple's potential disruption. Gradually, Apple is transitioning towards becoming a banking alternative.

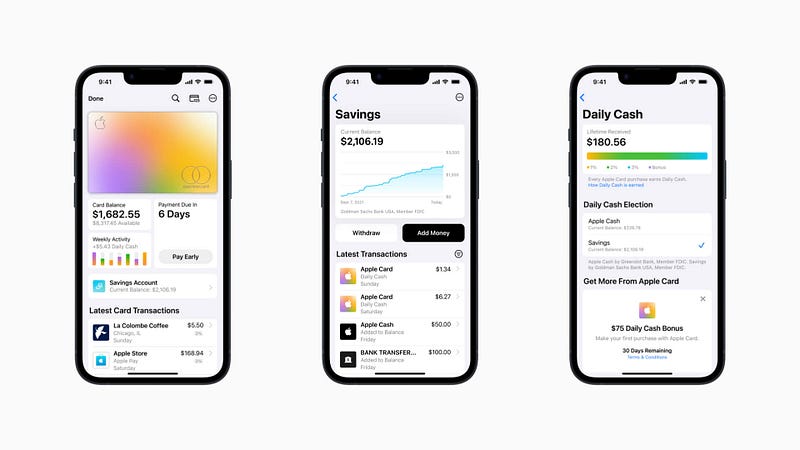

Apple has just revealed the launch of a new savings account, which offers a seamless experience for Apple Card users. This account can be effortlessly set up and managed within the Wallet app, featuring:

- Zero fees

- Attractive high-yield interest rates

- No minimum balance requirements

- No initial deposit needed

These appealing features will likely compel traditional banks to either match this offer or risk losing clients to Apple’s innovative approach. The best part? Users can establish this account using their iPhones without needing to visit a physical bank or fill out cumbersome forms.

The process is integrated directly into the iPhone, eliminating long waiting times for approvals. Once established, Apple will automatically deposit any Daily Cash earned into the savings account. Users also have the option to transfer these funds to their Apple Cash card within the Wallet app and can modify where their Daily Cash is directed at any time.

According to Jennifer Bailey, Apple's VP of Apple Pay and Wallet, this new feature allows Apple Card users to accumulate their Daily Cash rewards while also saving for the future. “Savings enhances the value of Daily Cash, providing an intuitive tool designed to promote healthier financial habits,” Bailey explains.

Users can easily add funds to their savings account from a linked bank account or their Apple Cash balance. Withdrawals can be made at any time without incurring fees, with funds transferred back to a connected bank account or the Apple Cash card. The Wallet app features a user-friendly dashboard called “Savings,” enabling users to monitor their balance and accrued interest effortlessly.

This initiative appears to be aimed particularly at younger consumers who would prefer to open a savings account through their trusted iPhone rather than visiting a bank in person. By 2030, I foresee Apple fundamentally altering our perception of banking.

Two More Disruptive Features to Consider

In early 2022, Apple introduced two additional features that sent shockwaves through the banking and payment processing sectors: Apple Tap To Pay and Apple Pay Later.

The first video, "Is Apple Savings Account A Game Changer?!," explores how this new offering could revolutionize personal finance.

Apple Tap To Pay turns any modern iPhone into a mobile point-of-sale (POS) device. This feature allows merchants—from small businesses to large retailers—to accept Apple Pay, contactless credit and debit cards, and other digital wallets with just a tap, without needing any additional hardware.

Bailey stated, “As consumers increasingly prefer digital wallets and contactless payments, Tap to Pay on iPhone will provide businesses with a secure and convenient method to accept payments.”

This is a remarkable innovation, and it's already being rolled out by payment platforms like Stripe.

Apple Pay Later, which launched with iOS 16, allows users to divide the cost of an Apple Pay transaction into four equal payments over six weeks, without interest or additional fees. What differentiates this from other buy-now-pay-later (BNPL) options is its seamless integration within the Apple ecosystem—no tedious application processes are required.

Users can enroll in Apple Pay Later directly through the Wallet app or during a purchase made using Apple Pay. This feature can be utilized at any online or app-based retailer that accepts Apple Pay and is part of the Mastercard network, which is widely available.

Moreover, Apple has introduced a new order tracking feature that provides detailed receipts and tracking information for purchases made with Apple Pay.

The second video, "Goodbye Mint. Here's a Perfect Budget Alternative: Buddy Budget Update! FULL REVIEW," discusses alternatives for managing finances effectively.

The traditional banking sector is facing a reckoning, as Apple continues to prioritize user experience and seamless integration of its services. Unlike banks, which often focus on features and numbers, Apple is committed to providing effortless and frictionless solutions.

What do you anticipate will be Apple's next significant moves in the financial sector? If you found this article insightful, consider following me on Twitter for more bite-sized resources and insights in tech and marketing.