Exploring Institutional Adoption: BlackRock and Bitcoin

Written on

Chapter 1: BlackRock's Groundbreaking Move

Are you weary of hearing about Bitcoin? Well, the conversation is just beginning.

Recently, BlackRock, the largest asset manager globally, announced a partnership with Coinbase, enabling its clients to purchase Bitcoin. This development is monumental, especially considering Fidelity—the foremost retirement plan provider in the U.S.—has also decided to allow Bitcoin investments within 401(k) plans.

BlackRock manages approximately $10 trillion in assets, surpassing the combined GDP of Japan and Germany. Additionally, it operates the Aladdin platform, which oversees a staggering $21 trillion in assets. To illustrate Aladdin's significance: Vanguard and State Street Global Advisors, the two largest fund managers following BlackRock, utilize this system alongside major global institutions like Japan’s $1.5 trillion government pension fund and tech giants such as Apple, Microsoft, and Alphabet.

While BlackRock itself has yet to invest directly in Bitcoin, its partnership with Coinbase paves the way for major institutions to securely acquire and hold Bitcoin. Fidelity, with over $4 trillion in assets under management, reinforces this trend toward institutional adoption.

Section 1.1: The Importance of Institutional Adoption

The entry of large firms into the Bitcoin market could be the catalyst that propels its value to new heights. Although individual investors and smaller institutions have already invested billions into Bitcoin, true mainstream adoption is on the horizon.

Currently, Bitcoin's market capitalization stands at $450 billion, but what will happen when investment behemoths like BlackRock and Fidelity start accumulating Bitcoin? With combined assets of $35 trillion, if merely 1% of this capital were allocated to Bitcoin, we could witness a substantial price surge, triggering considerable market excitement.

Subsection 1.1.1: Bitcoin's Finite Supply

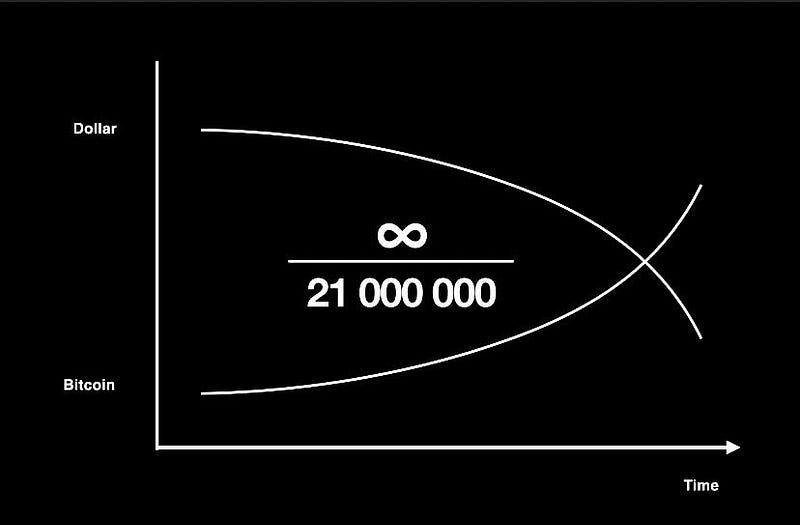

It's crucial to remember that Bitcoin's supply is capped at 21 million coins. This finite supply stands in stark contrast to the approximately $130 trillion worth of fiat money circulating globally, which continues to increase. The implications of this discrepancy are profound, as the limited availability of Bitcoin could become an increasingly attractive proposition for investors.

Chapter 2: The Future of Bitcoin with Institutional Support

In the first video, asset manager insights are shared on how Bitcoin is positioned to outperform other assets as institutional interest grows.

The second video explores how the world's leading asset managers are currently utilizing blockchain technology, providing a glimpse into the future of cryptocurrency investment.