Navigating the Energy Dilemma: Barriers to Innovation and Growth

Written on

Declining Technological Momentum

What indicates a significant slowdown in technological advancement over the past five decades? A clear sign is the apparent disinterest of the average U.S. citizen, the sitting president, and candidates for the presidency regarding advancements in electric vehicles (which have been around since the 1880s), artificial intelligence (emerging in the 1960s), or anti-obesity medications (available since the early 1900s). Instead, their focus is predominantly on fluctuations in crude oil prices, a commodity that gained prominence in the late 19th century.

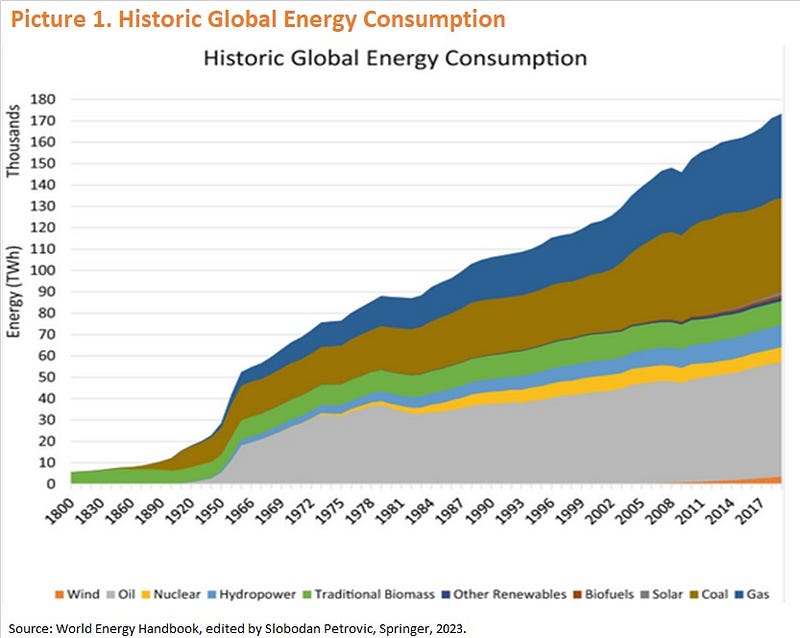

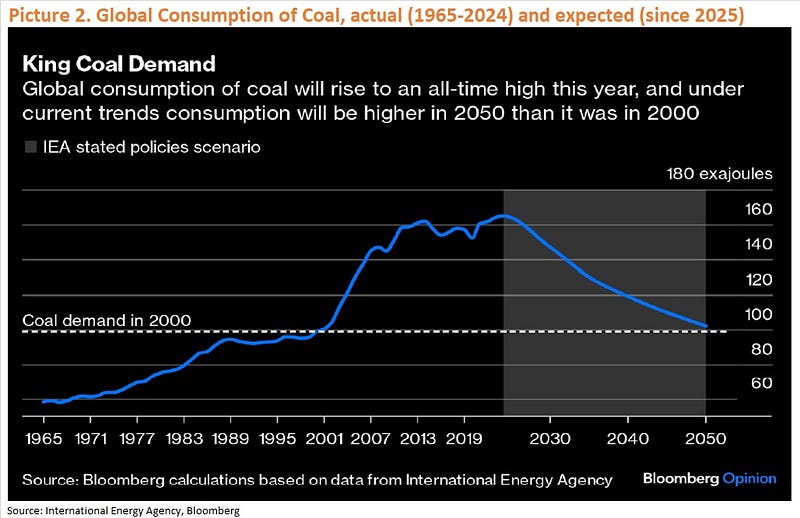

Moreover, both oil ("black gold") and natural gas ("blue gold") appear to be modern compared to the increasing demand for coal ("black diamond"), which has been the primary energy source driving the industrial revolution for the past three centuries.

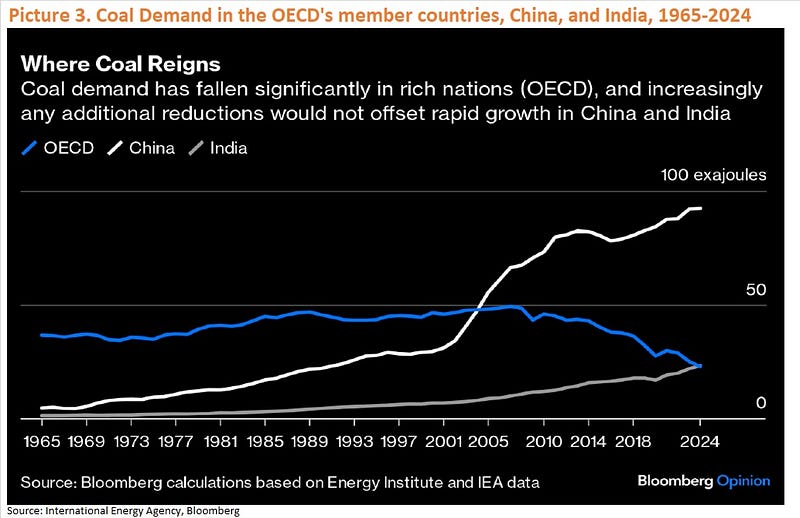

As noted by Bloomberg, “The dirtiest fossil fuel still powers the world. Talk of its demise is greatly exaggerated.” Coal continues to be a vital energy source for industrial growth in many developing nations.

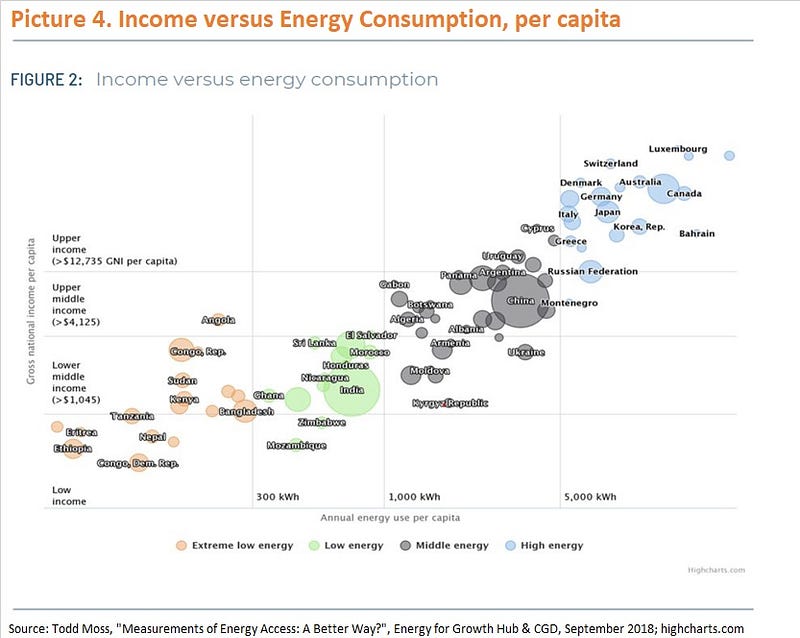

When developed nations advocate for reduced reliance on coal, oil, and natural gas to mitigate pollution, they may face demands to lower their own energy consumption. Developing countries recognize that economic progress and quality of life are closely tied to energy usage.

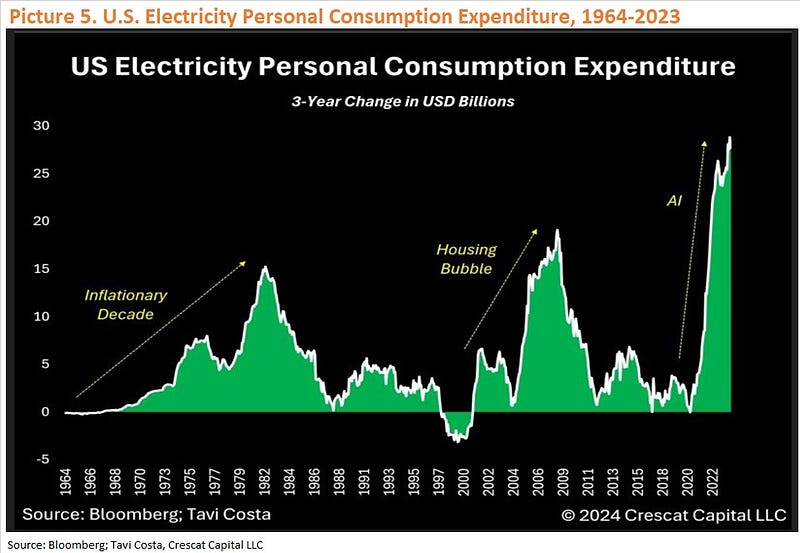

Additionally, the integration of recent technological advancements—such as electric vehicles, electric heating, AI tools, and cryptocurrency infrastructures—significantly escalates electricity demand.

Challenges Facing Renewable Energy

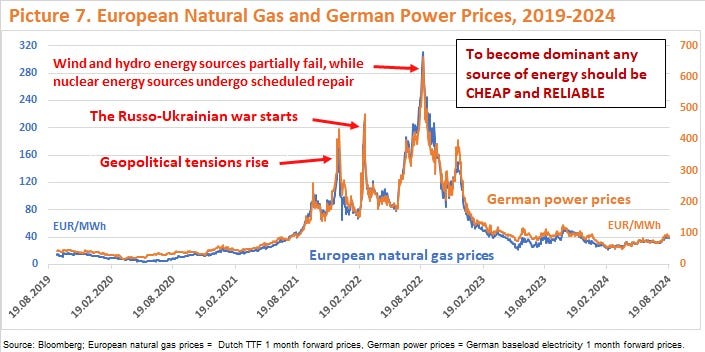

For any energy source to become dominant, it must be both affordable and dependable. While renewable energy—solar, wind, and wave—is gradually becoming more cost-effective, it still suffers from reliability issues due to ongoing technological hurdles in long-term battery storage.

Even in the Nordic countries, known for their favorable renewable energy conditions, there are significant challenges. Analysts have warned that declining profitability in renewable projects threatens green growth, emphasizing the need for flexible solutions like batteries and hydrogen production to attract investment.

On a global scale, the costs associated with developing hydrogen and renewable projects surged in 2023, and funding has become increasingly difficult to secure. As a result, project delays and cancellations have become commonplace, with only 2% of globally announced capacity currently under construction or operational.

In essence, hydrogen's high cost remains a significant barrier. According to Saudi Aramco’s CEO, blue hydrogen could equate to approximately $250 per barrel of oil. Without guaranteed off-take agreements, even in markets like Europe, prospects for blue hydrogen remain bleak.

The lesson from recent history suggests caution against expecting miraculous advancements in renewables; as the adage goes, “Hope for a miracle but don’t rely on it.”

Hydroelectric power plants have shown success, yet challenges persist in long-term storage solutions. For instance, pumped hydroelectric storage accounts for 32.6% of installed capacity in Switzerland, but figures in larger economies like Japan (8.8%) and the U.S. (2.1%) remain much lower.

Although Brazil has effectively utilized ethanol as a renewable energy source for decades, its unique agricultural advantages make its experience less applicable to most countries.

In the early 2000s, biofuels were touted as a solution to Europe's energy woes, but rising crop prices soon negated those hopes.

My conclusion is that, 17 years later, we still grapple with the same questions, leaving even advanced AI models puzzled.

The Color of Uranium: A Curious Debate

I once believed uranium was silvery white, but a heated debate within the European Union in 2022 revealed differing opinions—some claimed it was green while others argued for red. The perception of uranium's color seems to depend on proximity to nuclear facilities and the availability of alternative energy sources.

Notably, Bill Gates has invested in a nuclear power project in Wyoming, with the U.S. government supporting a significant portion of its costs. This investment highlights a growing acknowledgment that nuclear energy remains an essential, reliable energy source.

Despite public apprehension stemming from past nuclear accidents, no viable, low-cost alternatives exist. The situation in Europe in 2022, marked by low wind speeds and low reservoir levels, underscores the critical role of nuclear energy amidst geopolitical tensions. During that period, energy prices surged dramatically.

Hoping for Personal Energy Solutions

I envision a future where rising energy costs drive innovation in personal energy generators. Imagine harnessing energy from physical activities—walking, running, or cycling—creating a green solution that even the most skeptical could support.

If energy prices continue to trend upwards, we may find ourselves needing to exercise to power our devices, potentially even trading our generated energy with others.

While this idea may seem far-fetched, it echoes past predictions about technology and its evolution.

What does this mean for our political landscape and future prospects? In Part 5, we will delve into the chaotic political dynamics shaping our world and the various potential pathways forward. Stay tuned for more insights.