Navigating Health Insurance: A Global Perspective on Necessity

Written on

Understanding Health Benefits

When I received my initial job offer in the United States, I was perplexed by the concept of “benefits” associated with employment. Was it a free gym membership? Complimentary meals? Company outings? Ultimately, I discovered that the primary benefit provided by U.S. employers is health insurance.

Health Insurance Across the Globe

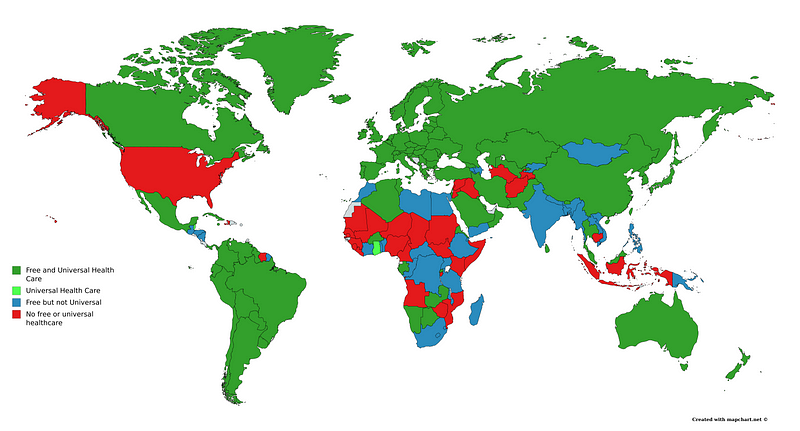

Having grown up in Germany, I experienced firsthand a universal health care system where coverage is viewed as a fundamental right rather than an additional perk. In Germany, health insurance companies (Krankenkassen) operate under government oversight, with premiums being shared between employers and employees, while the government subsidizes the unemployed. These insurers function as non-profit entities, contrasting sharply with the profit-driven motives of U.S. insurance companies, which often seek to minimize claims. Similar universal health care models are also prevalent in Japan, Belgium, and Switzerland.

Following my time in Germany, I had the opportunity to reside in Finland for several years, which also boasts a universal health care system but operates differently. In Finland, as in other Nordic countries and the U.K., health care is funded through taxes. This structure allows the government to negotiate lower costs, as many doctors are salaried government employees.

Challenges in Developing Nations

Numerous countries, including Cambodia, Burkina Faso, and rural parts of India and China, lack any form of health coverage. In these regions, individuals must bear the full cost of health care, leading to a situation where only the affluent can access medical services, leaving the poor vulnerable to illness and even death. This stark reality highlights the failures of health systems in these nations.

The U.S. health care landscape is a complex patchwork, with most individuals enrolled in employer-sponsored insurance plans. The government provides Medicare and Medicaid for others, yet approximately 9% of the U.S. population remains uninsured (as per the 2017 Census). For these individuals, accessing health care can be as challenging as it is in countries with no health coverage.

Employer and Employee Disadvantages

The U.S. health insurance system presents significant challenges for both employers and employees. For small businesses, providing health insurance for employees can be a heavy burden. During my job search in the U.S., I noticed that many recruiters promoted contractor positions, which typically lacked benefits, including health coverage—making them less appealing to me. Companies often prefer hiring contractors to sidestep some of these costs.

In contrast, Finnish start-ups do not grapple with health care concerns for their employees since the universal system covers them.

For employees in the U.S., the stakes are high: losing a job also means losing health insurance, which can lead to further financial strain. This concern is amplified if one becomes seriously ill and unable to work, resulting in a loss of both income and necessary health coverage—an unsettling prospect.

The Lemon Market Dilemma

The U.S. health care system also faces a significant challenge known as the lemon market problem. In a system where individuals can opt in or out of insurance, those with health issues are more likely to enroll, leading to a higher concentration of unhealthy individuals in the insured pool. This scenario forces insurance companies to increase premiums, perpetuating a cycle that may ultimately lead to their collapse. A universal system, which insures everyone, could effectively mitigate this issue.

Issues with Government-Provided Health Care

However, government-funded health care systems are not without their own complications. Deciding which treatments to cover poses a significant challenge. For instance, the National Institute for Clinical Excellence (NICE) in the U.K. evaluates treatments to determine what the government should fund. This task is daunting, as there are limited financial resources against an ever-expanding list of treatment options. As Tim Harford notes in The Undercover Economist, comparing the value of different treatments is an almost impossible task.

The Singaporean Approach

Harford proposes that an optimal health care system would require patients to cover small costs, such as checkups, while the government would handle exorbitant expenses like surgeries. This model encourages patients to be cost-conscious while ensuring they are protected against catastrophic expenses. Such a system is currently in place in Singapore, where workers contribute 7–9% of their income to a mandatory medical savings account for routine medical expenses, and catastrophic insurance provided by the government covers significant costs.

Conclusion: The Case for Universal Health Care

It is striking that the U.S. stands alone among developed nations without universal health coverage, despite spending nearly double on health care per capita compared to its peers. Countries like Germany, Finland, the U.K., and Singapore illustrate that successful universal systems are achievable.

This video explores why having health insurance is crucial, even for young and healthy individuals. It discusses the long-term benefits and financial security that insurance provides.

In this video, the basics of health insurance are covered, emphasizing its importance and how it impacts individuals and families.