# Is Codan (ASX:CDA) Practicing Big Bath Accounting? A Coincidence or Intentional?

Written on

Chapter 1: Introduction to Codan

Codan is a company that piques my interest due to its dominance in the metal detection market, generating significant profits from this sector. Notably, the company's earnings surged during the pandemic as job losses in regions like Africa led many to search for gold.

However, after the CEO's retirement, the stock price plummeted. The arrival of a new CEO coincided with a downturn in profits, leaving me questioning whether these financial losses were coincidental or a strategic move.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Anticipated Challenges in 2023

Codan had consistently warned that 2023 would be particularly challenging due to ongoing civil unrest in Somalia and supply chain disruptions stemming from the war in Ukraine. Their predictions proved accurate, as profits for 2023 fell compared to previous years.

What truly intrigued me was the uncertainty surrounding whether this profit decline was a mere coincidence or part of a deliberate strategy.

Subsection 1.1.1: Insights from Financial Shenanigans

In Howard Mark Schilit's book, "Financial Shenanigans," he notes that when a new CEO takes the helm amid substantial write-offs, it often indicates big bath accounting. This practice involves deliberately reporting losses to make future financial results appear more favorable.

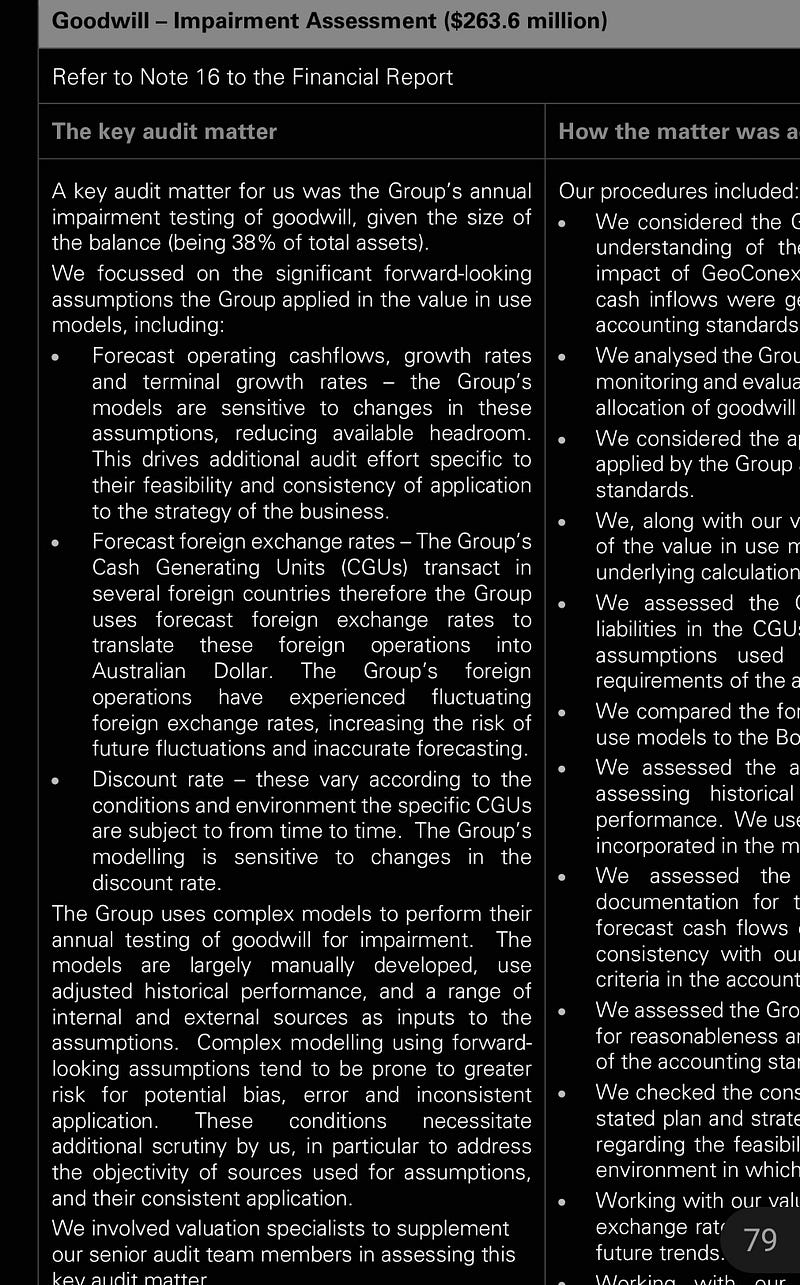

Section 1.2: Auditor's Warning

The most telling evidence of potential big bath accounting was highlighted by the company's auditor, who pointed out significant write-downs for 2023. Given the complexities of accounting, it can be challenging to reconcile various elements of financial statements with large goodwill impairments. Thus, I can only express my suspicions based on these observations.

If a substantial impairment is flagged, particularly during a new CEO's first year, it raises red flags.

Chapter 2: Codan's Growth Strategy

Codan has pursued an inorganic growth strategy since 2022, following through on its commitment to engage in acquisitions, particularly in tactical communication. These acquisitions were financed through bank loans and profits from their metal detection business.

The crucial point here is that acquisition accounting can be quite flexible. Companies can obscure losses in one area and attribute them to another. In this context, it’s plausible to suspect that losses from one segment could be shifted to another.

While this is speculative, the combination of a new CEO and common financial manipulations associated with such transitions makes me wary of potential big bath accounting here.

Conclusions

This analysis does not imply that Codan is a poor investment. I maintain that it remains a strong company, particularly in the profitable metal detection sector, where it holds a competitive edge as the market leader.

Despite facing challenges in 2023, Codan is still generating profits, albeit at a reduced level compared to prior years. The company also appears to be managing its finances responsibly, as evidenced by its debt repayment efforts.

Ultimately, big bath accounting may present an arbitrage opportunity. Typically, companies engaging in this practice experience subsequent years of recovery, which can be beneficial for patient investors.

Subscribe to DDIntel Here.

DDIntel highlights significant insights from our main site and our widely-read DDI Medium publication. Discover more valuable content from our community.

Register on AItoolverse (alpha) to receive 50 DDINs.

Follow us on LinkedIn, Twitter, YouTube, and Facebook.